Earnest money is one of the best ways to show a seller you’re serious about the offer you’re making on their home. By placing a portion of  your down payment on the table to demonstrate your commitment to follow-through on the contract, you’re saying “I love this home and I’m ready to go.” But there’s a real risk involved: If you make a mistake, you might just be out a chunk of cash.

your down payment on the table to demonstrate your commitment to follow-through on the contract, you’re saying “I love this home and I’m ready to go.” But there’s a real risk involved: If you make a mistake, you might just be out a chunk of cash.

Here are some ways to avoid burning your home-buying bankroll in lost earnest money:

- Make sure it’s the home you really want. Seem obvious? Sure. But it’s easy to get swept up in the moment. Recognize that you’re about to enter into a legally binding contract and that losing the money you’re risking will hurt if you change your mind. While you may not be able to drag your feet on the decision, check your gut to see if there are any reservations lurking there before you go all in.

- Don’t sacrifice contract contingencies. Don’t let your desire for a home cause you to blindly remove contingencies which are built into contracts to protect buyers. Common ones include loan contingencies, title search issues, and appraisal. Waive these at your own peril.

- Carefully consider committing to a home “as is.” If you’re putting earnest money on an offer for a foreclosed home, don’t be too eager to accept any problem the home may have. Take the time to understand the home’s issues before you write the offer.

- Read the contract timelines. Look at closing dates and other dates related to the process leading up to closing. Violating the timeline could cost you your earnest money as well.

- Ensure you have recourse to get some or all of your earnest money back. If the sale doesn’t gel, you and the property owner will need to sign a document voiding the agreement. Don’t sign this until you understand how it will impact your earnest money refund. The seller’s title can be negatively impacted if you don’t sign off, so keep your leverage handy until you’re sure you’ve been fairly treated.

Protect yourself and your down payment by playing smart with your earnest money. I will discuss the details of the contract with you, identifying where your earnest money is protected and where it may be at risk.

Ready to buy? Give me a call and let me help you find the right home and protect your interests along the way.

The Northwest received almost $330 million in Federal resources to revitalize our

communities, put people back to work and speed America back on the road to

recovery from what has come to be called “The Great Recession.”

In passing the Recovery Act, the Congress and the President specified a

wide range of activities to which state, county and city governments hard hit

by the downturn could apply Recovery Act funds – your tax dollars – from

meeting critical capital needs to expanding the supply of affordable housing,

from preventing homelessness to helping small businesses gain access to much

needed capital. Under the Act, those local governments were given full

authority to decide for themselves the specific what’s, where’s and how’s of

the projects that would best benefit their communities.

Here are some of the programs that will be funded

by the Federal money in the King County area:

- Promoting Energy Efficiency and Creating Green Jobs

- $40,250,758 to Washington State’s 29 housing authorities.

- $14,863,303 to 30 tribal organizations in Washington.

- Lead Hazard Reduction/Healthy Homes – $6,725,000 to to King County, City of Spokane

and State of Washington. - Supporting Shovel-Ready Projects and Assisted Housing Improvements

- Promoting Stable Communities and Helping Families Hardest Hit by the Economic Crisis

- Emergency Shelter Grant Program/Homelessness Prevention – $24,948, 653 to 10 grantees in Washington.

Recently, I was following another blog where a homebuyer was upset that they didn’t get the house they truly wanted because they were outbid. The homebuyer opened by saying that they lost the house because they low-balled the seller upfront and the seller decided to accept another offer. Consequently, they were not working with an agent and were receiving real estate advice from multiple sources. (more…)

Whether you’re a cat person, a dog person or something in between you may be impacted by the “pet restrictions” that are part of your next home purchase. When pet policies are part of a home’s or condo’s rules they can affect both your personal uses and investment potential.

For instance, in the Seattle market, I heard an interesting statistic that more home owners have pets than children (more…)

Seattle City Council has just adopted an updated plan for row-homes, townhomes, and cottages. The first decade of the millennium was full of new construction and a majority of designs in Seattle were the townhomes.

I don’t want to give you the wrong idea; I do not have anything against (more…)

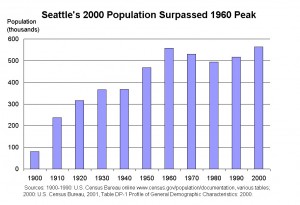

During this holiday season, it’s not just our waist lines that are experiencing growth. Washington is expected to receive another Congressional seat in the US House, all thanks to the population growth in Washington state. More specifically, the boom in the Seattle area is on the rise. (more…)

It’s official: FHA was just given authority to change the amount charged to borrowers for both the Up Front and the Annual Mortgage Insurance premiums…and change them they did.

Most of us still expect to see the hustle and bustle in the downtown areas like Seattle’s city center. Likewise, the expectation of the quiet life would be found in the suburbs. The future is here, and more than ever, you will find a little of everything in any given area. (more…)

When you are in the market to buy a condo there are some thing you need to know about Home Owners Associations (HOA). The HOA is responsible for building amenities, maintenance and, in some cases, utilities. As an owner, you may have some voting rights for the management of the budget, but the majority has the final say. I like to make sure that my homebuyers review the building’s finances to know whether or not the HOA is financially strong or as useless as a Deutsche mark.

This spring I handed house keys to a first time buyer who’d been dreaming of owning his own home for over ten years. In fact he’d been (more…)