The Northwest received almost $330 million in Federal resources to revitalize our

communities, put people back to work and speed America back on the road to

recovery from what has come to be called “The Great Recession.”

In passing the Recovery Act, the Congress and the President specified a

wide range of activities to which state, county and city governments hard hit

by the downturn could apply Recovery Act funds – your tax dollars – from

meeting critical capital needs to expanding the supply of affordable housing,

from preventing homelessness to helping small businesses gain access to much

needed capital. Under the Act, those local governments were given full

authority to decide for themselves the specific what’s, where’s and how’s of

the projects that would best benefit their communities.

Here are some of the programs that will be funded

by the Federal money in the King County area:

- Promoting Energy Efficiency and Creating Green Jobs

- $40,250,758 to Washington State’s 29 housing authorities.

- $14,863,303 to 30 tribal organizations in Washington.

- Lead Hazard Reduction/Healthy Homes – $6,725,000 to to King County, City of Spokane

and State of Washington. - Supporting Shovel-Ready Projects and Assisted Housing Improvements

- Promoting Stable Communities and Helping Families Hardest Hit by the Economic Crisis

- Emergency Shelter Grant Program/Homelessness Prevention – $24,948, 653 to 10 grantees in Washington.

Whether you’re a cat person, a dog person or something in between you may be impacted by the “pet restrictions” that are part of your next home purchase. When pet policies are part of a home’s or condo’s rules they can affect both your personal uses and investment potential.

For instance, in the Seattle market, I heard an interesting statistic that more home owners have pets than children (more…)

Seattle City Council has just adopted an updated plan for row-homes, townhomes, and cottages. The first decade of the millennium was full of new construction and a majority of designs in Seattle were the townhomes.

I don’t want to give you the wrong idea; I do not have anything against (more…)

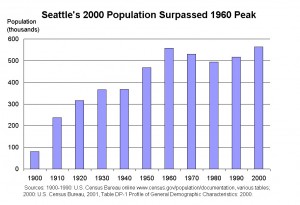

During this holiday season, it’s not just our waist lines that are experiencing growth. Washington is expected to receive another Congressional seat in the US House, all thanks to the population growth in Washington state. More specifically, the boom in the Seattle area is on the rise. (more…)

It’s official: FHA was just given authority to change the amount charged to borrowers for both the Up Front and the Annual Mortgage Insurance premiums…and change them they did.

When working with a homebuyer, I don’t start off by asking, “How much are you approved for buying?” The better question is, “How much of a payment is comfortable for you?” Typically, a homebuyer is pre-approved for an amount that is more than what they are willing to pay monthly. (more…)

When a homebuyer is purchasing a residential property, the seller is required to provide them with a Seller’s Disclosure Statement to detail any pre-existing conditions. Now, the million dollar question is whether or not everything in the disclosure statement is 100% true. Is it fact or fiction?

Consider that the homeowner is (more…)

FHA has been sustaining first time homebuyer market and lower price point homes through the collapse of the real estate market. Now that the market is slowly on its way to recovery, FHA is not so subtly backing away from their low down payment options, making it harder for a lot of homebuyers to buy their first home. (more…)